There are a great number of uncommon labels you to pop-up when you look at the discussions on lenders plus the financial world. Maybe you have pondered who Ginnie Mae was and you will exactly what she’s got regarding home loans. Freddie Mac computer or Fannie mae are also increased seem to. Will they be associated with Ginnie Mae? Following there is Irle. He is quite popular. The guy sounds Uk, correct? This type of names is actually familiar to help you financial experts, but tend to suggest little on mediocre consumer. Ginnie Mae, Irle, Freddie Mac computer, and Federal national mortgage association is an effective family in ways. All of them are acronyms linked to more home mortgage organizations and you will programs:

- Ginnie Mae ‘s the Government National Mortgage Organization (GNMA)

- Federal national mortgage association ‘s the Federal national mortgage association (FNMA)

- Freddie Mac are Federal Home loan Mortgage Agency (FHLMC)

- Irle is the Interest rate Protection Refinance mortgage (IRRRL)

Ginnie Mae drops into the Company out of Housing and you can Metropolitan Innovation (HUD). The roots go as far back as the good Despair, therefore is available to promote home ownership. Ginnie Mae is the top financial support sleeve to possess government financing. Virtual assistant money try a variety of bodies financing and generally are protected because of the You.S Institution from Pros Items (VA). An enthusiastic IRRRL is actually another type of Va refinance loan.

Virtual assistant Financial Program

The new pri should be to help eligible veterans funds the acquisition regarding belongings which have good mortgage terms and conditions and also at competitive interest rates. The expression veteran boasts productive responsibility Servicemembers, Pros, Reservists, National Shield members, and you may specific surviving partners.

A profit-Out Refinance loan are often used to pay back loans, financing university, generate renovations, otherwise refinance a non-Va home loan into the an excellent Virtual assistant home loan. Pros supply use of an IRRRL, a sleek re-finance program.

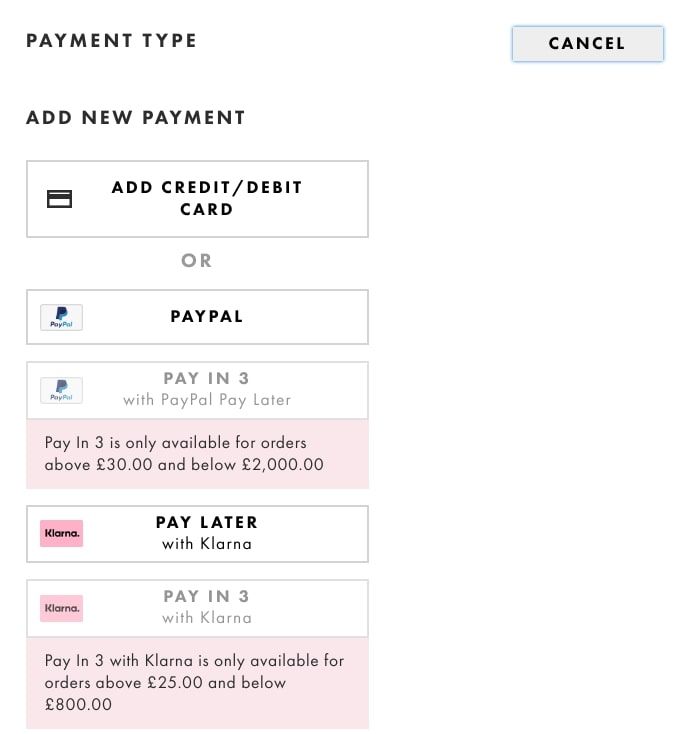

Individuals usually do not contact Ginnie Mae or even the Virtual assistant when they are interested inside a great Va loan. Like other mortgage brokers, he’s done owing to individual lenders, instance banking institutions and you can mortgage companies.

Advantages of Virtual assistant Mortgages

- Straight down rates of interest

- Zero deposit

- Zero mortgage insurance coverage

- Straight down fico scores

- Closure cost limitations

step 1. Straight down Rates

New Virtual assistant claims a fraction of per Virtual assistant loan, hence be sure support protect the lending company away from losings in the event your borrower doesn’t pay-off the loan. Because Virtual assistant money promote shorter risk than other variety of home loan loans, lenders is safe giving a reduced interest rate. A lower interest will benefit a debtor within the application procedure by allowing them to qualify for a much bigger loan amount. It can also result in the borrower expenses smaller within the interest over the life of the borrowed funds.

2. Zero Down payment

An effective Va financing doesn’t require a downpayment provided the newest deals rates doesn’t surpass the brand new appraised value of the house or property. Conversely, almost every other loan programs require an advance payment from from step 3.5 per cent to 20%. To be able to finance 100 per cent of one’s cost you will allow a debtor to find a property at some point when compared for other financing applications.

step 3. Zero Financial Insurance rates

Individuals are typically required to buy financial insurance rates whenever they try not to make a 20% deposit. Which insurance policy compensates the financial institution otherwise trader whether your debtor cannot result in the mortgage repayments and also the mortgage goes in default. Although not, just like the an effective Virtual assistant financing are guaranteed, financial insurance policy is not required and results in a benefit getting the https://paydayloansconnecticut.com/bantam/ fresh new debtor.

cuatro. Down Fico scores

Fico scores is a fundamental element of being qualified when it comes to family loan. A borrower having a lower life expectancy credit rating is considered to be a high chance than a debtor with increased credit history. The newest Va will not put credit history minimums to own Virtual assistant finance. The fresh new minimums are different with regards to the financial. But not, since the a great Va loan was guaranteed, the new debtor can expect way more autonomy plus the result is usually a reduced credit history lowest than what would-be accepted for other types of finance.